Paramount’s Ownership Stand for BET Media Group Amid High-Profile Industry Interest Featuring Tyler Perry, Byron Allen, Sean Combs

Credit: Google | Paramount picture and BET media group

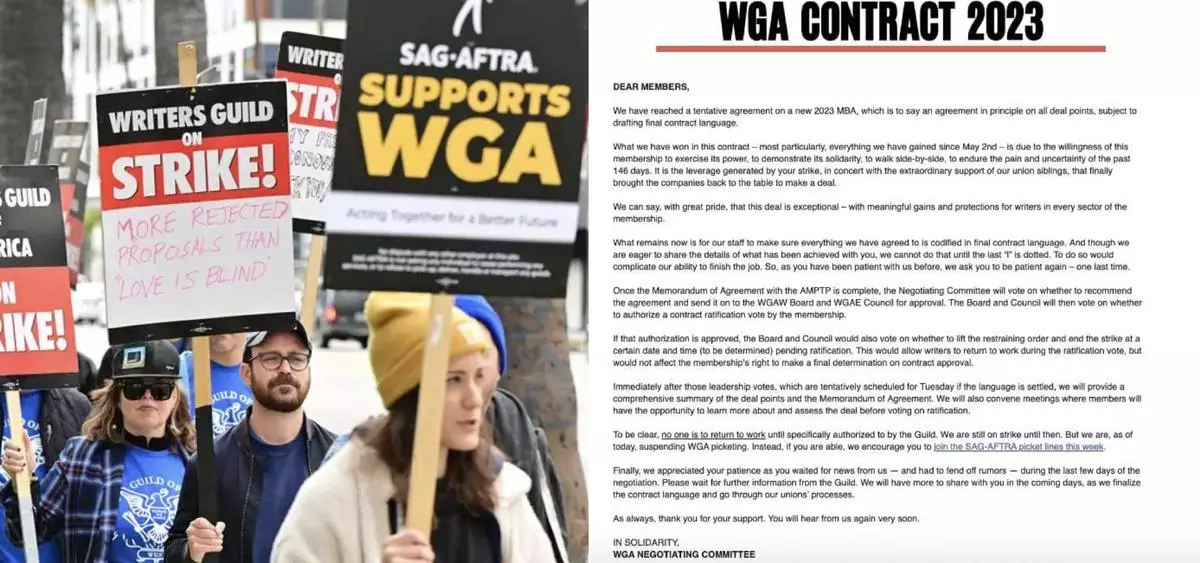

In a surprising turn of events, Paramount Global has opted against the sale of a controlling share in its esteemed BET Media Group, a conglomerate encompassing VH1, BET Studios, the BET+ streaming platform, and the flagship BET channel. This decision comes after an extended period of deliberation and considerable interest from industry heavyweights, including Tyler Perry, Byron Allen, and Sean “Diddy” Combs, who had expressed keen intentions to acquire a significant stake in the media entity.

The “for sale” sign has been taken down following months of negotiations, marking a strategic move by Paramount. Notably, bids ranging between $2 billion and $3 billion were reported, showcasing the lucrative nature of the acquisition. However, Paramount’s internal assessment indicated that a sale would not yield substantial benefits to its balance sheet, thus steering the conglomerate toward retaining its ownership.

Paramount Global has dropped its plans to sell a majority stake in its BET Media Group, which includes the VH1 and BET cable networks and BET+ streaming service https://t.co/3OBcmTSHNx

— WSJ Business News (@WSJbusiness) August 17, 2023

The trio of media moguls, Tyler Perry, Byron Allen, and Sean “Diddy” Combs, had emerged as noteworthy contenders in the bid to secure a majority stake in the BET Media Group. Tyler Perry, already entrenched in a content partnership with Paramount, expressed his vested interest in expanding his involvement. Byron Allen, known for his ambitious media endeavors, sought to augment his portfolio, while Sean “Diddy” Combs envisioned transforming BET into a prominent Black-owned global media platform, fostering representation and empowerment.

Paramount’s decision aligns with its overarching strategy of streamlining its assets to fuel growth in the dynamic streaming landscape. Despite amassing approximately 61 million global subscribers on the Paramount+ platform, the streaming division reported a second-quarter loss of $424 million, underscoring the challenges of profitability in an intensely competitive market.

The history of the BET channel dates back to its acquisition by Paramount in 2000 for a significant $2.3 billion in stock and $570 million in debt. While the channel initially reached 62.4 million households domestically, changing viewer preferences and the rise of digital alternatives have posed challenges for linear broadcasting. Paramount’s endeavors to evolve with the times have been evident through recent transactions, such as the sale of Simon & Schuster and strategic property divestitures.

Amid an environment characterized by rapid transformations, Paramount’s decision signals its commitment to strategic recalibration, as it navigates the entertainment landscape’s ever-shifting terrain. The conglomerate’s dedication to innovation and adaptation is exemplified through this pivotal choice to uphold ownership of the BET Media Group.

Ultimately, Paramount’s retention of the media conglomerate reflects its determination to establish a robust position in the entertainment realm while fostering a stronger connection with audiences worldwide. The intersection of industry dynamics, creative aspirations, and community impact continues to steer Paramount’s trajectory, shaping its narrative in an era of unprecedented change.

RELATED NEWS

WEB STORIES FOR YOU

Stay connected with Today On Globe for the latest Global Issues and News Updates.

Explore more related articles at [TOG News / TOG Article]